Microsoft’s Cloud Hits 50 Billion Dollars: Microsoft experienced a substantial rise in second-quarter finances with unaudited revenues posted at $81.27 billion as well as non-GAAP earnings of $5.16 per share. This reflects a large increase from last year’s second quarter when revenues stood at only $73.76 billion alongside non-GAAP earnings of $5.06 per share. In addition, Microsoft has also surpassed $50 billion in Cloud Services revenue for the first time (reported $51.5 billion compared to $40.9 billion last year’s second quarter).

Not only cloud services experienced strong growth but key business areas performed well too; for example Office 365 provided revenues of $34.1 billion while Intelligent Cloud which includes Azure provided revenue of $32.9 billion – both exceeded Wall Street expectations.

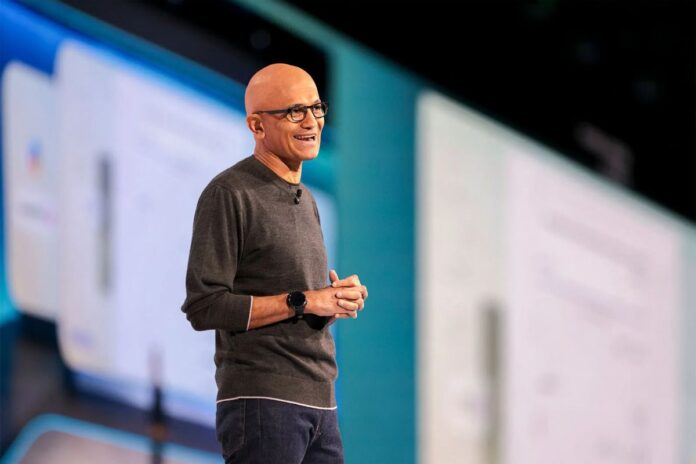

According to CEO Satya Nadella, Microsoft still considers itself ‘early’ in their artificial intelligence journey; in addition he added “I do believe this technology will provide long-term value not only to our customers but also to our partners”.

Why the Stock Fell Despite Good News

Even with strong numbers, Microsoft’s stock fell as much as 10% on Thursday. Investors are worried that cloud growth may be slowing and that Microsoft is spending too much money on AI.

The company spent $37.5 billion on capital investments this quarter, much higher than last year. Much of this spending is going toward building AI data centers and infrastructure. Microsoft also admitted it cannot meet all AI demand yet because it lacks enough capacity.

Another closely watched number, remaining performance obligations, reached $625 billion, with nearly half tied to OpenAI deals. While this shows strong future demand, it also highlights how dependent Microsoft’s AI growth has become.

Competition in the AI Race Is Heating Up

Microsoft remains a major player in AI, helped by its early investment in OpenAI. Its market value briefly passed $4 trillion earlier this year. Still, investors are watching rivals closely.

Microsoft’s stock is up 7% over the past year, beating Amazon’s small gains. However, Google has surged 69%, driven by excitement around its Gemini 3 AI model, which many see as a new industry leader.

As AI spending grows and competition increases, investors are asking whether Microsoft can keep up its momentum without hurting profits.

Share your opinion what you feel about Microsoft investing heavily into AI; is investment into AI a positive long-term acquisition or negative, based upon what Wall Street analysts are saying? Feel free leave a comment with your thoughts.

Read More : Dow Slashes Thousands of Jobs as Automation Takes Center Stage